An individual who has taken an education loan for higher education can avail the tax deduction under Section 80E of the Income Tax Act 1961The best part about this deduction is one can avail it even after availing the maximum provided deduction of Rs1 50 000 under Section 80C. Here is the latest income tax slabs and income tax rates for FY 2021-22 and FY 2022-23.

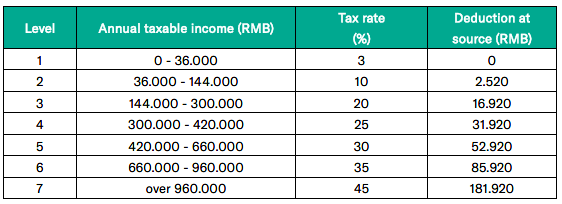

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia.

. Taxpayers can also avail an addition income tax rebate of Rs. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year.

Generally if an investment is not tax-free then you would owe taxes on the realized gains. Tax rates range from 0 to 30. This calculator forecasts your possible tax burden providing you with an estimate that you can use for research purposes.

Simply click on the year and enter your taxable income. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Domestic travel travelling within Malaysia expenses have RM100000 tax relief.

50 000 under section 80CCD 1B subject to self-contribution or deposit to their NPS account or Atal Pension Yojana. This income tax calculator can help estimate your average income tax rate and your take home pay. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

The personal income tax rate in New Zealand is progressive and ranges from 105 to 39 depending on your income. Free calculator to find the sales tax amountrate before tax price and after-tax price. This calculator is not suitable for persons liable to income tax USC and PRSI as a self-employed contributor For the status of married with two earners for the purposes of the calculation the salary figures of the spouse should be input separately.

How many income tax brackets are there in New Zealand. Income Tax Reliefs for Tax Residents in Singapore either local or foreign tax-resident. Additional tax relief of RM500 for any expenditures related to purchase of sporting equipment rental of sporting facilities payment of registration or competition fees.

Value-Added Tax VAT. Greece India Canada Singapore and Malaysia. The calculator is based on the information available at the time of publication in January 2022 and is subject to change.

Also check the sales tax rates in different states of the US. The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2022. The combined income tax rebate in India which can be availed under sections 80C 80CCC and 80CCD 1 is capped at Rs.

For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. The income tax system in New Zealand has 5 different tax brackets. Sage Income Tax Calculator.

Income Tax Calculator for AY 2023-24 FY 2022-23 AY 2022-23 FY 2021-22 AY 2021-22 FY 2020-21 to use for tax computation and to compare old vs new tax regime scheme for IT or Investment declaration with your employer. The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2021. This is because the correct amount.

Get tax saving worth RM300000 for childcare expenses for children up to 6 years old. Tax Benefits under Section 80E. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers.

The participating banks are as follows. Malaysia Income Tax Brackets and Other Information. In particular deviations might be observed when the gross salary input is too high or too low.

FREE for 1st year in India refer pricing for other countries such as India Australia Malaysia Nepal Pakistan. The calculator treats the investment gain ROI as realized and the taxes get deducted on the first cash flow date after the first of each year. Our Income Tax Calculator for Individuals works out your personal tax bill and marginal tax rates no matter where you reside in Canada.

First of all you need an Internet banking account with the FPX participating bank. Even though the progressive rates for personal income tax rates range from zero to 22 percent in Singapore the effective payable tax may come out to be much lower if one takes advantage of the various schemes the Singapore Government has initiated. For more information about or to do calculations involving income tax please visit the Income Tax Calculator.

Setting the Calculator up for Income use the following variables. 1 Pay income tax via FPX Services. Its so easy to use.

The income tax slab and rates for FY 2021-22 is important as it is needed to calculate income tax amount while filing ITR this year and the income tax slabs and rates for FY 2022-23 is need to know how much tax-saving investments you need to do to reduce your tax outgo. Here are the many ways you can pay for your personal income tax in Malaysia. PAYE became a Final Withholding Tax on 1st January 2013.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Final in the sense that once an employer deducts PAYE from the gross salarywage of a particular employee it represents the final tax liability on that income. Calculate how tax changes will affect your pocket.

As a result most employees will not be required to lodge Form S returns. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Income Tax Formula Excel University

10 Things To Know For Filing Income Tax In 2019 Mypf My

How To Calculate Income Tax In Excel

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

How To Calculate Foreigner S Income Tax In China China Admissions

Individual Income Tax In Malaysia For Expatriates

7 Tips To File Malaysian Income Tax For Beginners

How To Calculate Income Tax On Salary Shop 58 Off Www Ingeniovirtual Com

How To Calculate Income Tax On Salary Shop 58 Off Www Ingeniovirtual Com

How To Calculate Income Tax On Salary Shop 58 Off Www Ingeniovirtual Com

What You Need To Know About Income Tax Calculation In Malaysia Career Resources

How To Calculate Income Tax On Salary Shop 58 Off Www Ingeniovirtual Com

How To Calculate Income Tax In Excel

Tax Calculator For Rental Property Best Sale 50 Off Www Ingeniovirtual Com

How To Calculate Income Tax In Excel

Tax Calculator Excel Spreadsheet Youtube